I need to clarify that I am not in the oil and gas industry. Whatever I blog about are just my trash! I will not responsible for your lost in your investment! :P

Prediction Vs Facts

The United States Energy Information Administration predicted in 2006 that world consumption of oil will increase to 98.3mb/d (15,630,000 m3/d) (mbd) in 2015. The fact according to OPEC Monthly Oil Market Report dated September 2015, as per to the date of their record, the consumption rate is at 92.79mb/d. The consumption rate forecast for 2016 will be lowered due to the slow down of economic activities and rising of renewable energy sector.

Set aside all the market factors, let us take a deep look at behind the science of oil production. Similar to any commodity, the earth resources are finite. I grew up in Kampar, Perak, which was once a famous tin mining town rich of natural tin resource. Nowadays, the town no longer produce enough tin for the industry. All we left were the emptied abandoned ponds of water. Therefore, I realize the fact that if the rate of harvesting the natural resources are higher than the reproduction rate, one day, the resources will be all gone, used up, and left emptied.

The World's natural oil supply is fixed because petroleum is naturally formed far too slowly to be replaced at the rate at which it is being extracted. - Wikipedia

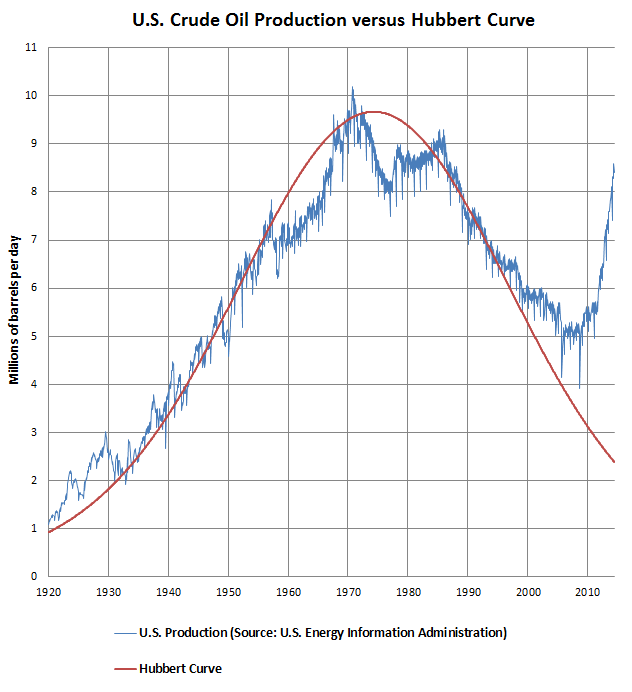

Therefore, let us take a closer look at the chart below. If we assume that the oil production is irrelavant to market price and global events, naturally, the Hubbert theory should be applied. Due to the new recovery technology, we now able to boost the production of the oil, which causes a sharp rise of the production which violates Hubbert's theory.

And The Crystal Ball Saids

It is abnormal to see such chart pattern. The sharp rise of the production may also signal that there could be a sharp fall when the oil field is at its end of production life.The recent mainstream news had focused too much on the market, the price and the OPEC. It is the fact that most human only care about money making, but they never realized the end of oil age is near. What happened now, with the global oil price slump, is actually beneficial to the oil consuming countries such as United States. The increase of their oil inventory is a smart move. They collect as much as they can to prepare for the coming end of their own oil field.

The Iran Deal?

The real reason behind the Iran deal could be more than what we had expected. Just imagine when United States no longer able to produce enough crude oil, and once again, they had to depend on major producers such as Saudi Arabia. The Americans are smarter than that! Lets open this can of worms! There has been significant development on the re-newable energy sector. Other than that, the solar, wind or biofuel might not be enough to feed the power hungry nation. Furthermore, there are many other products which were produced by petroleum. Therefore, to have good terms with the 4th largest oil reserve country is a smart move to gaurantee some great deal in the future.

Store The Cheap Oil Now

The oil inventory is growing every week. If the future oil price will go lower in price after the Iran sanction lifted, then why store it if you already know that it's going to be cheaper tomorrow. The "Theory" is, they want to store it because they don't know when they are going to ran out of oil! It could happened anytime, any year. The oil field could just suddenly emptied. They don't want the huge oil producers to know that! Therefore, the price is always speculated to the down side.

Conclusion

I'm just trashing! :P stay cool and enjoy!

No comments:

Post a Comment